Business-to-business (B2B) e-commerce platform Udaan has raised $114 million in its Series G funding round. The round was led by M&G Investments and Lightspeed, with support from both current and new investors.

Earlier in February this year, Udaan had already raised $75 million as the first part of its Series G funding round.

According to Media reports, the company’s value at that time was estimated to be around $1.8 billion—similar to the earlier $340 million funding round led by M&G Plc, with support from Lightspeed and other investors.

Udaan will use the new funds to grow its product categories and reach more customers, especially in areas like fast-moving consumer goods (FMCG) and the hotel, restaurant, and catering (HoReCa) sector.

The company also plans to expand its own branded products in the staples category, improve its financial health, and get ready for a possible IPO in the future.

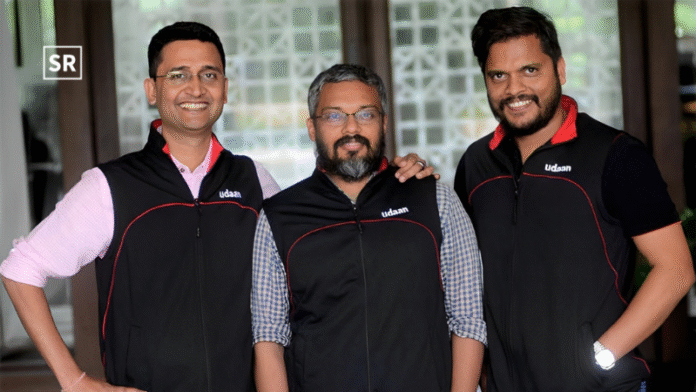

“Over the last 3 years, we have transformed the business by building cost as a capability and a competitive advantage. We have reduced our EBITDA burn by 40% every year for the last 3 years and are on track to achieve full group EBITDA profitability in the next 18 months,” said Vaibhav Gupta, co-founder and CEO of Udaan.

Udaan said it grew more than 60% in 2024 compared to the previous year. It also improved its profit margin by over 3% and reduced its fixed costs by 20%.

Thanks to these efforts, the company cut its losses (EBITDA burn) by 40% in 2024 and has already reduced it by another 20% in 2025.

In the financial year 2024, Udaan’s total sales (GMV) grew only slightly by 1.7%, from ₹5,609.3 crore in 2023 to ₹5,706.6 crore.

However, the company reduced its losses by 19.4% to ₹1,674.1 crore, showing that it has improved in managing costs and running its operations more efficiently.

Udaan started in 2016, is an online platform that helps connect manufacturers, wholesalers, traders, and retailers across India. It offers products in many categories like electronics, lifestyle, home and kitchen, groceries, medicine, and industrial goods.

With this new funding and a clear focus on profits and growth, Udaan now wants to strengthen its position as a top player in B2B commerce in India. The company is also getting ready for its long-awaited stock market launch (IPO).

With this new funding and a strong focus on making a profit, Udaan is preparing to stay a major player in India’s fast-growing B2B market. As the company looks ahead to a possible IPO, everyone will be watching to see if it can keep growing as promised and continue improving its efficiency.

Read more- Indian Fintech Startup Spense Secures $1.85 Million in Pre-Seed Funding