Elevation Capital, the firm that invested in Paytm, Swiggy, Meesho, and Urban Company, is starting a new $400 million fund called Elevation Holdings.

Unlike their usual focus on early-stage startups, this fund will invest $20–50 million each in 10–15 companies that are preparing to go public.

This comes at a time when private funding in India is slowing down, so many startups are looking at the stock market to grow and raise money.

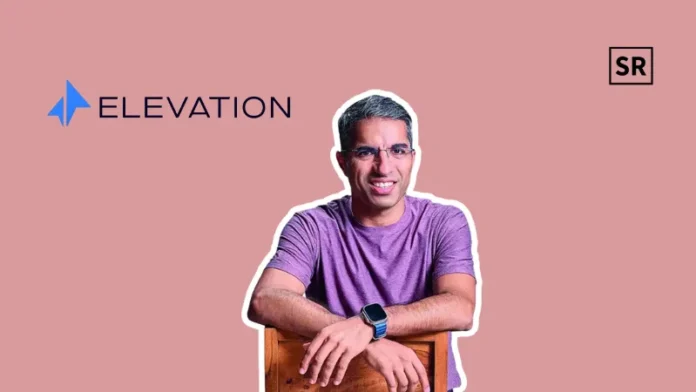

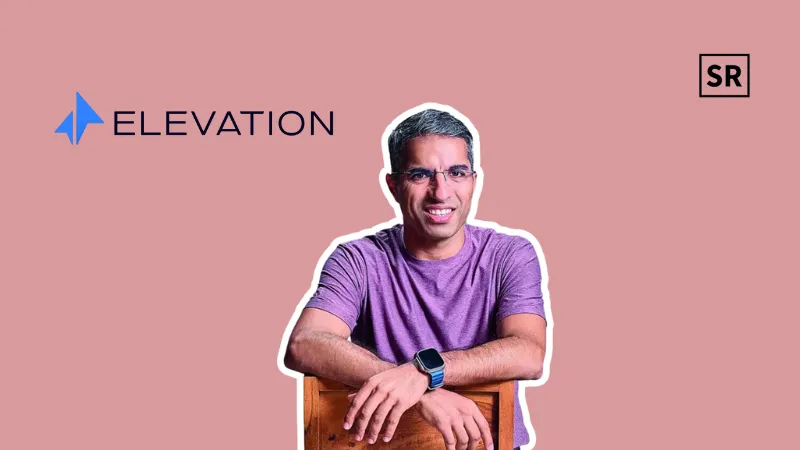

Co-managing partner Mukul Arora said the new fund will mostly support technology-based companies in consumer and financial services. He also mentioned that Elevation Holdings is different from the typical growth funds that many VC firms have started in recent years.

“Our horizons for investments are much longer and we will hold long enough to be considered permanent holders of the stock. We also have the flexibility in terms of having a non-intrusive cheque size for a company of that scale,” said Mridul Arora, partner, Elevation Capital.

“Also, while these investments are at a late stage, we are bringing our venture DNA to the fore. For many founders at that stage, interactions are primarily with typical public market investors, many of whom are focused on the next quarter or the next year. But we would be great partners to think about the longer term,” he added.

Accel and Peak XV (formerly Sequoia India) have separate growth funds to help more established companies.

In the same way, Elevation Holdings will work alongside Elevation Capital’s $670 million Fund VIII, which still focuses on early-stage startups, investing $2–5 million in each.

“There is now greater confidence in the fundamentals of the companies getting created. If you look at traditional Indian businesses from the last few decades like Asian Paints, HDFC Bank or Titan, they have compounded year after year, decade after decade…this is for the first time, we feel that some companies in our technology ecosystem can reach that level of maturity,” Mukul Arora said.

Elevation Holdings will focus on companies that are within three years of going public and are already profitable or nearly profitable. Its first investment is in the used-car marketplace Spinny.

Mukul Arora said the fund is not limited to Elevation’s current portfolio and can also invest in other startups.

Mridul Arora added that companies like Meesho, Swiggy, and Urban Company would have been good candidates if this fund existed earlier. He also said the fund can invest through primary deals, secondary deals, or by buying employee stock options.

Read more- Q-CTRL Secures AU$38M DARPA Contracts to Develop GPS-Free Quantum Sensors