China makes up more than 24% of AMD’s total revenue, making it an important market for AI and data center products.

Advanced Micro Devices (AMD) expects a $1.5 billion drop in revenue for 2025. This is due to recent U.S. rules restricting the export of advanced semiconductors to China.

China currently makes up more than 24% of AMD’s total revenue, making it a key market for AI and data center products. The new export restrictions are expected to significantly affect AMD’s sales in the second and third quarters of the year.

The updated forecast shows how U.S. policy changes have a bigger impact by limiting China’s access to advanced computing technology.

Even with the predicted drop in revenue, AMD reported first-quarter revenue of $7.44 billion, a 36% increase compared to last year. Adjusted earnings per share for the quarter were 96 cents, better than analysts expected.

The company’s data center division earned $3.7 billion in sales, a 57% increase from the previous year. This growth was mainly driven by continued demand for AI-related computing infrastructure.

AI demand is expected to offset near-term pressures.

AMD expects its revenue to stay around $7.4 billion for the second quarter. This includes a boost from customers speeding up their orders to avoid future tariffs or supply issues.

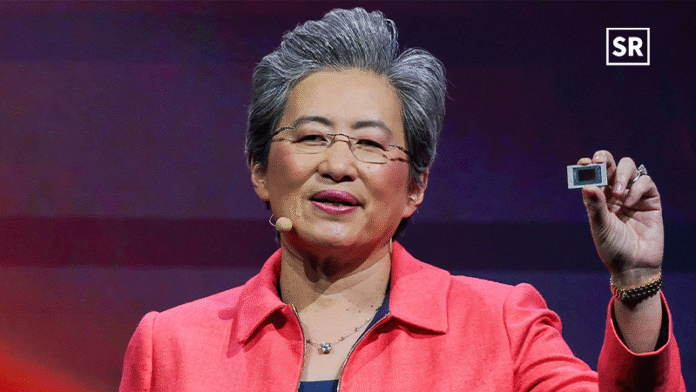

The company also expects its AI business to keep growing, with strong demand leading to double-digit increases in data center revenue in the coming months. AMD CEO Lisa Su said, “We expect strong growth in our data center business driven by AI, even as we deal with the export restrictions.”

The updated forecast reflects a larger trend in the semiconductor industry as several U.S.-based chipmakers adjust their predictions due to changing trade policies. Nvidia recently reported a $5.5 billion loss due to similar export restrictions showing the extent of the disruption in the industry.

The semiconductor market has been dealing with increased geopolitical attention as the U.S. continues to focus on advanced chip technologies for national security reasons.

Export controls affect chips that can support generative AI applications and other sensitive high-performance computing tasks.

Investors have shown concern about future sales in China following the update. However, AMD’s strong performance in AI and server processors suggests that there is still strong demand in markets that are unaffected by the restrictions.

AMD hasn’t shared specific changes to its supply chain or manufacturing plans, but it has said that it is focused on meeting international demand and following the rules set by the U.S. government.

In March 2025, AMD completed the $4.9 billion purchase of ZT Group International, also known as ZT Systems, a company specializing in hyperscale servers. This happened after receiving approval from the European Commission.

The acquisition will help AMD create complete AI solutions by combining its CPU, GPU, and networking components with its open-source ROCm software and advanced rack-scale systems.

Read also – Standard Chartered Launches ‘Women and Tech’ Initiative to Boost UAE Startups