Weekly Funding Roundup 16 June to 21 June 2024– We compile a Weekly Startups Funding News Report summarizing all the startups that secured funding during the week. This report provides a consolidated list of these newly funded ventures day-wise, offering a concise overview of the latest developments in the startup funding landscape.

Asian Startups raised capital in order to expand and move into more successful. Here is this week’s Top 10 Asian Startups Funding Roundup.

Top 10 Asian Startups Funding News 16 June to 21 June 2024

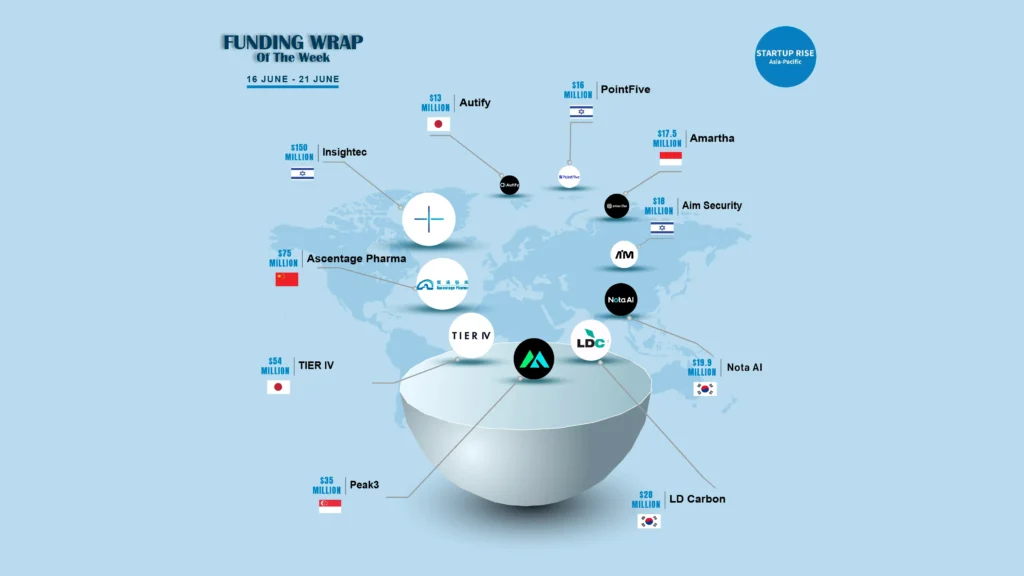

Funding Wrap of The Week | Asian Startups Funding Roundup | 16 June – 21 June

Table of Contents

Insightec

Insightec, a global healthcare company dedicated to using focused ultrasound to transform patient care, has raised $150 million in equity financing.

The round was led by Fidelity Management & Research Company and co-led by Nexus Neurotech Ventures and Ally Bridge Group. Support from new investors, Baillie Gifford, Catalio Capital Management, Fayez Sarofim & Co., and Gilmartin Capital, along with strong support from insiders, led by affiliates of York Global Finance / Community Fund and Perceptive Advisors generated an oversubscribed round.

Ascentage Pharma

Ascentage Pharma (6855.HK), a global biopharmaceutical company engaged in developing novel therapies for cancer, chronic hepatitis B (CHB), and age-related diseases, announced that the agreed equity investment by Takeda has been closed on June 20, 2024, with all proceeds already received.

Pursuant to the terms of the Agreement, it has allotted and issued an aggregate of 24,307,322 subscription shares to Takeda International at the share purchase price of HK$24.09850 (equivalent to approximately US$3.08549).

TIER IV

Expanding its Series B fundraising round, TIER IV, a leader in open-source software for autonomous driving systems, has raised an additional US$54 million (¥8.5 billion).

With this, the company has raised US$243 million (¥38.1 billion) in total capital, bringing the Series B funding to US$132 million (¥20.7 billion).

Peak3

ZA Tech, the next-generation insurance core system SaaS provider, has rebranded as Peak3. With the successful completion of its US$35 million Series A fundraising from EQT (lead investor) and Alpha JWC Ventures, Peak3 now accelerates its expansion in the EMEA region and investments in complementary data and AI solutions.

With the funds, Peak3 will expand its EMEA operations, forge new alliances with system integrators, and enhance its analytics and AI skills toward an intelligent core insurance solution.

LD Carbon

A $28 million Series C fundraising round was secured by LD Carbon, a recovered carbon black manufacturer situated in Seoul, South Korea.

With participation from Meritz Securities, Investwith, Industrial Bank of Korea, Hyundai Motor Group ZER01NE, Elohim Partners, and New Main Capital, Woven Capital, Toyota’s expansion fund, led the round.

Nota AI

South Korean firm Nota AI, secured $19.9 million (25.8 billion KRW) in its Series C fundraising round.

With this, the total amount of money raised since the organization’s foundation has reached about $42.6 million (53.2 billion KRW). Leading the round were LB Investment and STIC Ventures, with additional investments coming from Mirae Asset Securities, Korea Development Bank, and STIC Ventures.

Aim Security

Aim Security, an Israeli startup that makes it possible for enterprise organizations to safely adopt and deploy AI, has raised $18 million in Series A funding.

Canaan Partners led the investment, with YL Ventures joining. The funds will be used by the business to grow both its operations and growth initiatives.

Amartha

Through its Accion Digital Transformation Fund, international nonprofit Accion provided an equity funding of US$17.5 million to microfinance fintech company Amartha.

The new funding will be used to support Amartha in developing a platform that will use AI and data to offer financial services and goods to underserved women-owned small enterprises in rural Indonesia.

PointFive

PointFive, a cloud cost optimization platform for enterprise companies specializing in uncovering deeper, typically overlooked, cloud waste has raised $16 million in seed funding.

The round was led by Index Ventures with participation from Entree Capital, Sheva Capital, and Vesey Ventures, and angel investors, including Assaf Rappaport, CEO and Co-Founder at Wiz; Mickey Boodaei, CEO and Co-Founder at Transmit Security; Tamar Yehoshua, Former Chief Product Officer at Slack; Rakesh Loonkar, Amiram Shachar, Guy Podjarni, David Politis, Dean Sysman and additional notable angels.

Autify

Autify, an AI platform for quality engineering has completed a Series B funding round of $13 million and released a beta version of Zenes, an autonomous AI agent for software quality assurance.

Leading the round are LG Technology Ventures, the Silicon Valley-based venture capital division of LG Group, which focuses on AI, enterprise software, and energy transformation, and Globis Capital Partners, a renowned venture capital firm with headquarters in Tokyo, Japan.

Frequently asked questions (FAQs)

Name the Top 10 Asian Startups Funding Roundup in this week ?

Insightec, Ascentage Pharma, TIER IV, Peak3, LD Carbon, Nota AI, Aim Security, Amartha, PointFive, Autify, are the Top 10 Asian Startups Funding Roundup in This Week.