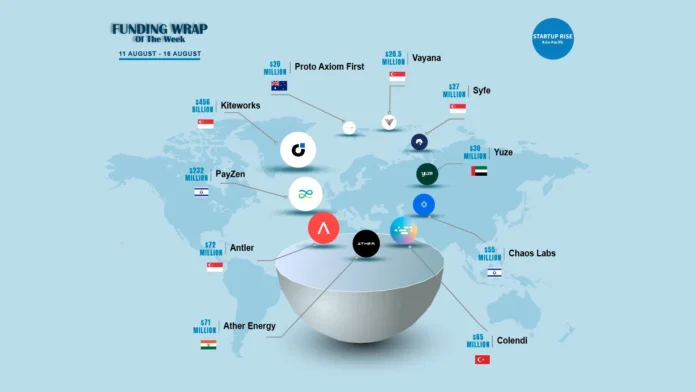

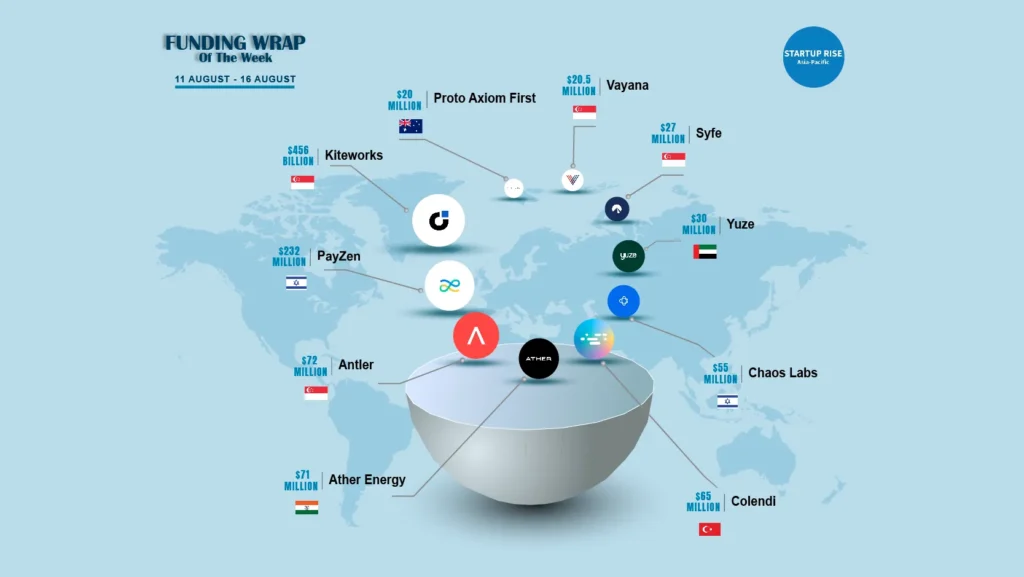

Asian Startups raised capital in order to expand and move into more successful. Here is this week’s Top 10 Asian Startups Funding Roundup.

Table of Contents

Kiteworks

Kiteworks, a secure content communications firm situated in San Mateo, CA, Singapore has raised $456 million in Funding.

Sixth Street Growth and Insight Partners were among the backers. The Kiteworks board of directors will include Alex Katz from Sixth Street, Peter Sobiloff from Insight Partners, and Eoin Duane from Kiteworks.

PayZen

A $232 million Series B fundraising round was secured by PayZen, a San Francisco, California and Israel-based finance technology business that uses AI-powered solutions to address healthcare affordability.

Leading the round was NEA, with participation from 7wireVentures, SignalFire, Viola Ventures, and other current investors.

Antler

Antler, a Singapore-based global early-stage VC firm with offices in over 30 countries including Singapore, Jakarta, Ho Chi Minh, and Kuala Lumpur, closed its US$72 million second Southeast Asia fund.

Antler SEA Fund II has institutional investors such sovereign wealth funds, pension funds, and university endowments as half of its Limited Partners.

Ather Energy

Famous electric scooter maker Ather Energy has joined the unicorn club after a lucrative investment round of $71 million from its current backer, the National Investment and Infrastructure Fund (NIIF). With this most recent fundraising round, Ather is now valued at $1.3 billion, or roughly Rs 10,900 crore.

After Rapido, which just received $120 million in funding from WestBridge Capital and reached a post-money valuation of $1 billion, Ather becomes the fourth unicorn in India this year and the second in the mobility industry.

Colendi

At a valuation of $700 million, Citicorp North America Inc. led a group of investors in Turkey’s fintech company Colendi, which obtained an additional $65 million in fundraising.

In addition to Citicorp, the Series B round included participation from Migros Ticaret AS, Sepil Ventures, Re-Pie Asset Management, Finberg, and Hedef Holding, as stated by Bulent Tekmen, the chief executive officer and co-founder of Colendi, formerly known as Colendi Yapay Zeka ve Buyuk Veri Teknoloji Hizmetleri AS. He added that current investors participated in the round as well.

Chaos Labs

The blockchain risk management platform Chaos Labs raised $55 million in Series A funding headed by Haun Ventures and included new investors F-Prime Capital, Slow Ventures, and Spartan Capital. The startup has raised $70 million.

Omer Goldberg, the CEO, launched Chaos Labs in 2021. The company employs 29 people, the majority of whom are situated in the Tel Aviv R&D center with offices in New York. According to the company, its technology has obtained loans totaling $25 billion, incentives of $35 million, and trade volume of $765 billion cumulatively.

Yuze

Osten Investments is the lead investor in $30 million raised by UAE-based fintech Yuze. Yuze, a company founded in 2022 by Rabih Sfeir, supports financial inclusion by offering business accounts to startups, micro, and small companies in emerging nations.

The additional capital will help Yuze expand into new areas and achieve one million SME and professional customers in five years.

Syfe

The Singapore-based savings and investing platform Syfe said , that it has completed a $27 million funding round, raising the total amount of money raised to $79 million and improving its valuation.

In a statement, Syfe noted that in addition to current investors Valar Ventures and Unbound, the all-equity funding round includes fresh investment from two family offices in the United Kingdom with holdings in the banking and fintech industries.

Vayana

The trade credit infrastructure platform Vayana, situated in Singapore, Pune, India, has secured $20.5 million in continuous Series D funding.

Leading the round was SMBC’s Asia Rising Fund, with participation from family offices including Quantum State Investment Fund and Emerald Company Pvt. Ltd., as well as current investors like the International Finance Corporation (IFC), Chiratae Ventures, and Jungle Ventures.

Proto Axiom

In order to strengthen Australia’s biotechnology (biotech) industry by retaining more intellectual property (IP), Proto Axiom, an Australian biomedical technology incubator, today announced the $20 million first close of its intended $30 million Series B.

Proto Axiom has a cash value of $90 million as of the September 2022 announcement of the $15 million Series A and the Series B first close.

Name the Top 10 Asian Startups Funding Roundup in this week ?

Kiteworks, PayZen, Antler, Ather Energy, Colendi, Chaos Labs,Yuze,Syfe, Vayana, Proto Axiom are the Top 10 Asian Startups Funding Roundup in This Week.