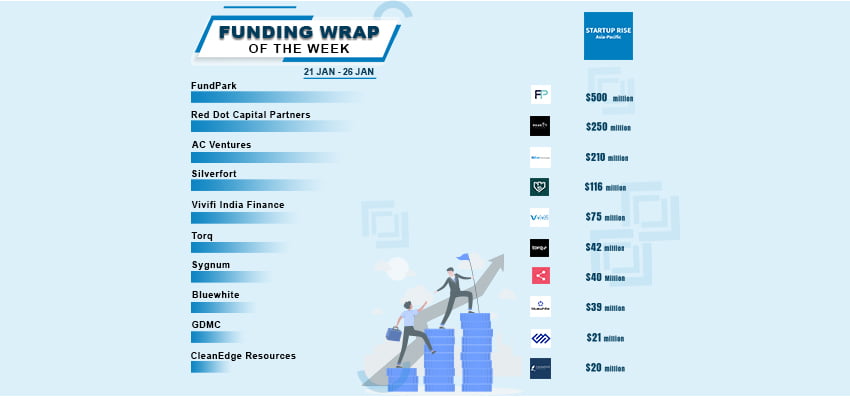

This week, there are many funding deals for growth-stage and early-stage agreements in the Asian startup Funding ecosystem; Let’s talk about the Top 10.

The Top 10 Asian Startups Funding of This Week

FundPark

Goldman Sachs doubled the preeminent Asia-based eCommerce liquidity solution and technology provider, FundPark’s asset-backed securitisation facility to up to US$500 million.

Founded in 2016, FundPark Limited is a fintech scale-up with a vision to power fast-growth digital entrepreneurs to realise their growth potential and drive prosperity. FundPark has developed a digital platform to support fast growth digital enterprises, by delivering insights and capital that bridge their needs to growth.

Red Dot Capital Partners

Red Dot Capital Partners completed the first closing of third fund, securing investor commitments exceeding $200 million. The fund invests across Israeli tech industry sectors, including enterprise software, fintech and cybersecurity.

Founded in 2016, Red Dot Capital Partners is an Israel-based expansion and early growth venture fund investing in breakout technology companies. Red Dot supports its portfolio companies in identifying and navigating expansion opportunities in fast developing markets and within its LP’s networks and businesses – with a focus on SE Asia and Japan.

AC Ventures

AC Ventures announced the final close of US$210 million fifth investment fund (ACV Fund V). With the support from both existing and new limited partners, including institutions such as The World Bank’s IFC – International Finance Corporation and other global investors from the US, the Middle East, and North Asia.

Founded in 2020, AC Ventures is a an early-stage technology venture fund that focuses on investing in Indonesia’s digital disruptors. Formed through the merger of leading VC firms Agaeti Venture Capital and Convergence Ventures, AC Ventures’s mission is to partner and support entrepreneurs with more than capital, combining operating experience, industry knowledge and deep local network to bring value.

Silverfort

Silverfort, celebrates raising $116M in series D funding, bringing the total amount raised to $222M. Brighton Park Capital (BPC) led the round, with participation from existing investors including Acrew Capital, Greenfield Partners, Citi Ventures, General Motors Ventures, Maor Investments, Vintage Investment Partners and Singtel Innov8.

Silverfort is the Unified Identity Protection company that pioneered the first and only platform, enabling modern identity security everywhere. By connecting to the silos of the enterprise identity infrastructure, Silverfort unifies identity security across all on-prem and the cloud environments.

Vivifi India Finance

Hyderabad, India-based Fintech NBFC company, Vivifi India Finance has raised USD 75Mn funding in Series B round in a mix of debt and equity.

Vivifi India Finance’s vision is to offer Innovative Financial Products to customers across the Credit Spectrum, leveraging Technology and Data Science, with focus on underserved/unserved customers. Working to become India’s largest lender, VIVIFI aims to provide credit for the non-prime borrower with completely automated fulfillment.

Torq

Torq has secured $42 million in an extension to its Series B Funding Round and raised the total funding to $120 million. The investors in the round included Insight Partners, GGV Capital, Bessemer Venture Partners, Greenfield Partners, and Evolution Equity Partners.

Established in 2020 by Ofer Smadari, Leonid Belkind, and Eldad Livni, Torq is transforming cybersecurity with its pioneering enterprise-grade, AI-driven hyperautomation platform. By connecting the entire security infrastructure stack, Torq makes autonomous security operations a reality.

Sygnum

Sygnum has raised more than USD 40 million against an initial ~USD 35 million target in an interim close of its latest funding round, which is named the Strategic Growth Round. As of the completion of this interim close the company’s post-money valuation stands at USD 900 million.

Sygnum is a global digital asset banking group, founded on Swiss and Singapore heritage. We empower professional and institutional investors, banks, corporates and DLT foundations to invest in digital assets with complete trust.

Bluewhite

Bluewhite has secured $39M Series C financing led by Insight Partners, with participation from new investors Alumni Ventures and LIP Ventures, among others. Existing investors Entrée Capital, Jesselson, and Peregrine Ventures also participated in the financing round.

Founded in 2017, The Bluewhite mission is to build resilient farms by maximizing the grower’s productivity and reducing their operational cost. We equip existing fleets with autonomous technology, an easy-to-use platform, and end-to-end service; supporting their journey to a more profitable and sustainable farm.

GDMC

Genetic Design and Manufacturing Corporation (GDMC) has secured US$21 Million in Series A Funding round led by private equity manager, Celadon Partners and also saw participation from WI Harper Group, SEEDS Capital, and NSG Ventures.

Founded in 2021, Genetic Design and Manufacturing Corporation (GDMC)’s mission is to exponentially increase the availability of genetic medicines and change millions of patients’ lives. GDMC achieve this by partnering and supporting early-stage companies and investigators with innovative therapeutic modalities such as gene therapies or nucleic acids.

CleanEdge Resources

As part of its broader USD 500 million climate investment strategy aimed at actively reducing CO2 emissions in Asia, responsAbility on behalf of investors invests USD 20 million in Singapore-based CleanEdge Resources.

Headquartered in Singapore, CleanEdge Resources is a leading environmental company offering disruptive technologies for industrial wastewater treatment and waste to energy solutions with a focus on resource recovery and sustainability.

These startups played a major role in Asian Startups Funding ecosystem in this week and secured funding from Venture Capitalists, Angle Investors in different funding Rounds.