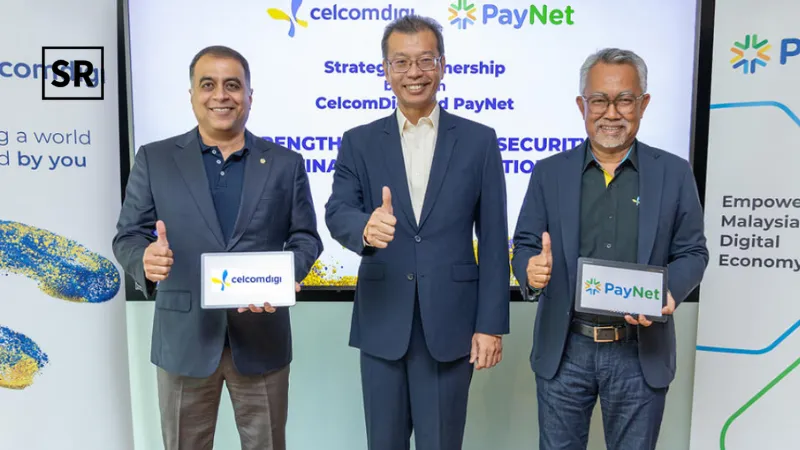

Malaysian telecommunications company CelcomDigi Berhad and the country’s payment network Payments Network Malaysia Sdn Bhd (PayNet) have announced an industry collaboration to use CelcomDigi’s Open Gateway to give Malaysians easier and safer access to digital financial services.

According to a statement released by CelcomDigi on Wednesday, this partnership utilizes open application programming interface (API) integration to support Malaysia’s drive for increased digital security by providing businesses and individuals with safe and easy financial transactions and promoting a more connected digital ecosystem.

Read more – CelcomDigi & PayNet Partner to Enhance Digital Security in Financial Transactions.

This collaboration is primarily focused on taking proactive measures to combat the growing risks of online fraud and scams, which continue to be a major obstacle in the current digital financial environment.

It has been observed that scammers frequently take advantage of holes in user security procedures, targeting weaknesses in access and authentication procedures.

By strengthening digital safeguards and drastically lowering such dangers, this alliance hopes to eradicate these vulnerabilities.

According to the Open GSMA Initiative, this collaboration allows PayNet to use secure SIM-based authentication to validate DuitNow transactions by utilizing CelcomDigi’s Open Gateway API.

Read more – Malaysia’s Okapi Secures Up to $2M Debt Financing from Aquila for Solar Expansion.

This security measure guarantees that the registered account holder is the owner of the mobile number associated with a DuitNow user ID.

This strategy works especially well with DuitNow, which employs business registration numbers, MyKads, or cellphone numbers as user IDs for transactions.

The statement claims that SIM-based authentication provides important security advantages.

Because each SIM card is distinct, safely kept inside a mobile device, and difficult to copy, there is a lower chance of fraud and frauds.

This is particularly important because financial and banking scams remain one of the most common types of fraud in Malaysia.

Currently, PayNet handles more than 13 million online transactions daily.

SIM-based authentication offers consumers a more secure option than conventional authentication techniques that rely on OTPs, which necessitate manual code entry and are vulnerable to human intervention hazards.

Through cooperation with financial institutions and the National Scam Response Centre (NSRC) through the National Fraud Portal (NFP), this relationship also improves digital security.

In order to enable CelcomDigi to take proactive steps to promptly identify, block, and blacklist phone numbers associated with scams, NFP streamlines the process of managing scam reports and shares real-time fraud intelligence.

Additionally, by preventing fraudsters from utilizing blacklisted numbers to open new accounts, this method strengthens user security

“This landmark collaboration between the telecommunications and payments industries is aimed at further safeguarding all Malaysians,

“By enabling SIM-based authentication technology, we are providing financial institutions with a more secure way to authenticate users, making digital financial transactions significantly safer,” said Idham Nawawi, CelcomDigi’s Chief Executive Officer.

“As scams and fraud rise—especially in the age of artificial intelligence—this initiative comes at a pivotal moment, reinforcing the need for stronger security as scammers grow more adept at bypassing traditional defences and exploiting digital vulnerabilities,

“We look forward to expanding this partnership, working with more financial institutions to strengthen digital security and protect Malaysians across the country from emerging digital threats,” he added.

“At PayNet, our mission is to build a secure, seamless, and inclusive digital financial ecosystem for all Malaysians,

“With the 2024 launch of our real-time National Fraud Portal, we took an innovative, bold step towards protecting Malaysians,” said Farhan Ahmad, Group Chief Executive Officer of PayNet.

He claims that this collaboration enhances the National Fraud Portal by including real-time account verification via CelcomDigi, giving every user an additional degree of protection.

“By harnessing Open APIs and collaborative innovation, we are driving a future where financial security and inclusion go hand in hand, empowering individuals and businesses to transact with confidence in an increasingly digital economy,” he added.