Early Roots & Industry Frustrations

Insurance has long been criticised as opaque, fragmented, and driven by legacy systems rather than user experience. In the late 2010s, a group of executives and entrepreneurs recognised that the market was ripe for change: a digital platform could connect carriers, distributors, and end-users in a seamless ecosystem.

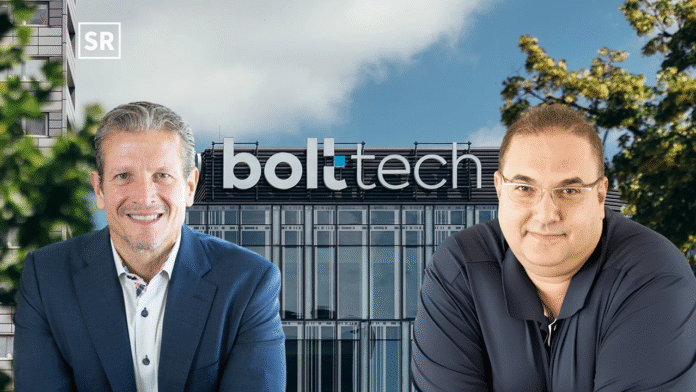

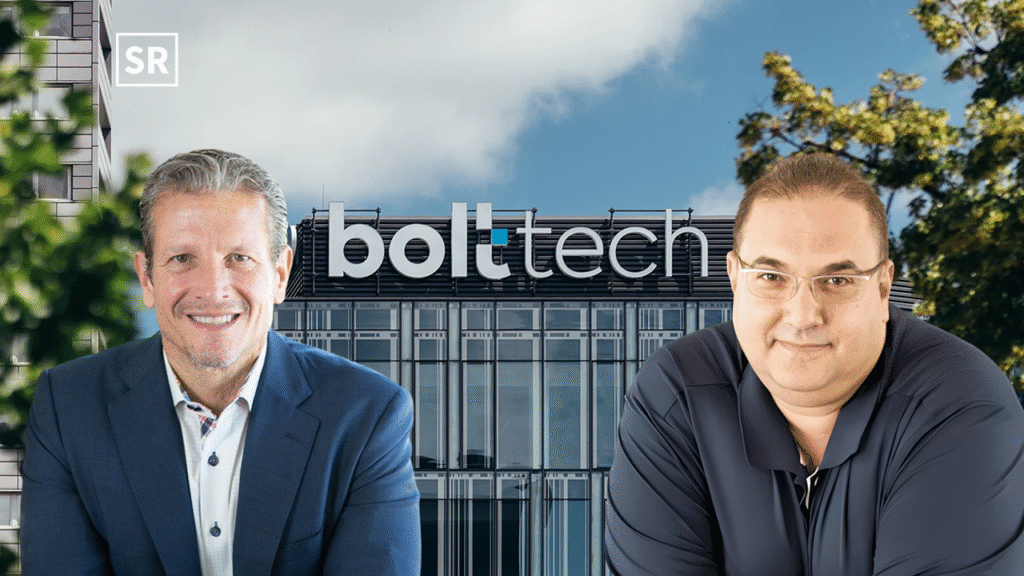

Rob Schimek, with a 35+ year career in insurance and finance, and Eric Gewirtzman, a seasoned insurtech founder, became central to this vision.

Meet the Founders

Rob Schimek (Founder & Group CEO of bolttech)

Rob holds a Bachelor of Science in Business & Accounting (Rider University) and an MBA from the Wharton School of Business. His career spans senior leadership at AIG (including President & CEO of its Americas and EMEA operations) and significant roles at FWD Group and Deloitte. He is described as the founder of Bolttech, leading its global operations across 35 + markets.

Eric Gewirtzman (Co-Founder of bolttech / founder of bolt)

Eric has a strong insurtech background, previously founding Bolt Solutions and building digital insurance platforms in the US. He served as CEO of the US operations of “Bolt” and was appointed to lead Bolttech’s insurance exchange strategy globally.

Together, Rob and Eric combine deep industry experience, operational leadership, and digital-first thinking.

Read Also- When Chopsticks and Curiosity Collide: The Story of Stick’ Em

The Spark: Building the “Insurance Exchange”

The idea behind Bolttech was to create a platform that isn’t just an insurance company, but an ecosystem — a marketplace/exchange where carriers, MGAs, distributors, and technology could meet, integrate, and deliver protection embedded into products and services—for example, insurance embedded in consumer electronics, device protection, mobility, device-insurance bundling, and more.

The company is credited with becoming one of the world’s largest embedded insurance platforms, facilitating tens of billions in premiums annually.

Building the Business & Milestones

- While the exact foundation date is sometimes cited as 2020, one source notes, “Founded in 2020 by Eric Gewirtzman and Rob Schimek” for Bolttech.

- Bolttech has rapidly expanded with a presence in dozens of markets across Asia, Europe, North America, and more. Rob has spoken of balancing growth, profitability, and global execution.

- The company completed substantial funding rounds: for instance, one article reports $147 million Series C at ~US$2.1 billion valuation.

- Leadership shifts: In 2021, Bolttech announced that Eric would become CEO of its global insurance exchange business, joining the executive committee.

Strategy & Competitive Landscape

Bolttech positions itself not merely as an insurance carrier but as a tech-driven distribution and exchange hub. Rob Schimek explains that their platform enables choice of carriers, of product, of channel, and embeds insurance into the customer journey, rather than making insurance the centre of the transaction.

The business model focuses on B2B2C partnerships, API-based integration, embedded protection (devices, mobility, services), and the orchestration of products and carriers rather than owning all the infrastructure—the result: faster go-to-market, scalability, and global reach.

Leadership Philosophy & Culture

Rob emphasises people, purpose, and global execution. In interviews, he notes how building high-performing teams across cultures, selecting the right markets, and executing smart growth rather than just fast growth are keys to their success.

Eric, meanwhile, has stressed the importance of distribution, modern tech stacks, and re-thinking the old insurance operating model. In a profile, he notes that “digital distribution is the key to growth, but fewer than 25% of insurers are pleased with their efforts to date.”

Challenges & Turning Points

- Entering insurance means heavy regulation, legacy systems, trust, and compliance — changing this terrain is slow.

- Proving the value and ROI of embedded insurance (and platform economics) requires time and scale. Some press pieces point to a “revenue puzzle” despite large premium volumes.

- Balancing growth with profitability across regions and product lines is complex. Rob has publicly discussed choosing markets and pace wisely.

- Building an exchange model (many partners, many products) means focusing on the ecosystem, not just the product. The leadership emphasises that insurers don’t need to do everything; the platform enables them.

Impact & Why This Story Matters

- Bolttech’s story is a prime example of how technology can reshape traditional industries — in this case, insurance.

- The founders’ backgrounds show that deep industry experience (Rob) plus startup/mode thinking (Eric) can form effective leadership for digital transformation.

- The emphasis on embedded insurance, platform model, global scale, and distribution-first approach is a blueprint for 21st-century insurtech.

- Their focus on choice, user experience, and partner ecosystems means insurance becomes less about paperwork and more about product integration.

- Building from, but transcending, legacy insurance architecture is a significant challenge — their story helps illustrate how.

The Road Ahead

For Bolttech and its founders, the following phases likely involve:

- Further global expansion into new markets, localising products, and navigating regulations.

- Deepening embedded insurance reach: devices, mobility, IoT, services, new verticals.

- Strengthening technology: data, AI, customer experience, real-time underwriting, APIs.

- Moving toward profitability and scalable operations across all regions (not just pockets).

Maintaining the balance between partner ecosystem and direct control to deliver value.