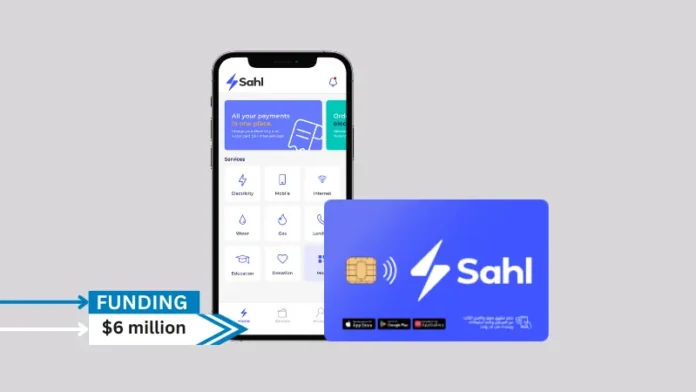

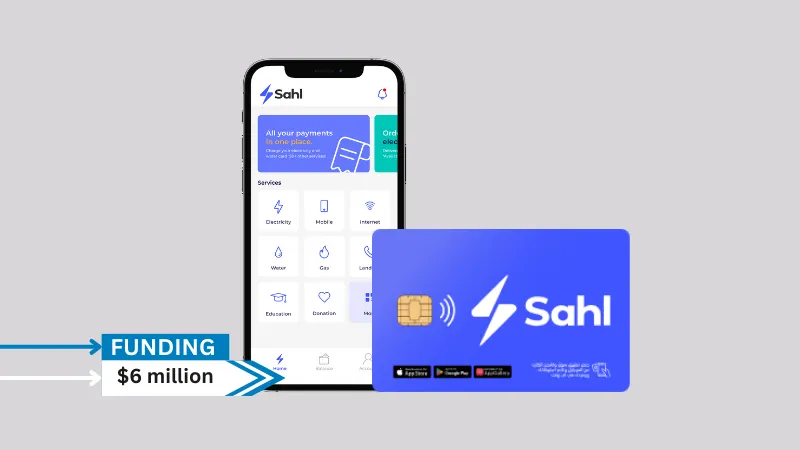

Sahl, a Cairo-based business, raised $6 million in Series A and seed funding to provide a one-stop shop for family expenditures with government agencies. Ayady for Investment and Development, a leading Egyptian investment group that has supported innovative businesses, led the Series A round, joining Egypt Pay, Delta Electronic Systems, and E-Finance.

With the current funding, it will become a full-service financial provider. The company will use these funds to improve and create new products that are frictionless, fast, and secure. It wants to open offices in the KSA, Egypt, and others after a successful UAE launch.

Read also – Singapore-Based XM Studios Partners with Emerge Group

It aims to dominate Egypt’s EGP 2.5 trillion digital payments business. They hope to achieve this by seizing a large percentage of utility company collections, worth EGP 250 billion yearly. To strengthen its leadership, Sahl wants to form strategic relationships that open new distribution channels, technology collaborations, and co-marketing opportunities.

“At Sahl, we are committed to addressing the challenges faced by consumers in utility payments, starting with electricity and expanding to water, gas, telecom, and various other essential services,” said Abdullah Assal, CEO. “Our innovative use of NFC technology eliminates the need for consumers to leave their homes to charge prepaid cards, saving valuable time and effort.” Ahmed Othman, CPO, added, “Sahl is our direct contribution to offering a world-class experience in terms of reliability & UX in a market that has always compromised the end user.”

It is one of the few Egyptian enterprises directly integrating with government agencies. This makes it easy to use services from the Egyptian Electricity Holding Co. (EEHC), NUCA for water, all telecom companies (Vodafone, WE, Orange, and Etisalat), Petrotrade for gas, Cable Network Egypt for TV, and others.

Read also – UAE-Based Proptech Stake Secures $14 Million in Series A Funding

Sahl has recently expanded into B2B through two product lines. The Services Gateway centralises bill payment services for payment processors, digital applications, and organisations, creating a more linked financial ecosystem. The Acceptance solution streamlines financial operations by enabling businesses to accept online payments.

The founders of Sahl have disrupted Egypt’s financial services and payments industry. Their ambitious vision relies on each member’s distinct skills. Abdullah Assal, VP of Globaltronics, Egypt’s utility metre market leader, has extensive industry knowledge. As an investment banker at CI Capital, Sahl’s CPO Ahmed Othman refined his financial and strategic skills. Ibrahim Assal, who worked at Palantir, Careem (an Uber subsidiary), and Microsoft, completes Sahl’s tech staff. This combined knowledge allows the Sahl team to transform digital payments, especially in utilities.

Sahl has served over 12 million clients and 15 million households in Egypt since its 2020 founding. Users can use the app to pay bills for utilities like electricity, water and gas, as well as telecommunications top-ups, tuition fees, television subscriptions and donations, saving them 30 minutes per transaction. They handle billions of Egyptian pounds with 50+ services.

About Sahl

Sahl is an Egyptian mobile bill payment software that lets users pay over 50 services, including electricity, gas, water, and mobile.