Bengaluru-based NBFC Techfino has raised INR 65 crore (about $7.5 million) in funding from Stellaris Venture Partners and Saison Capital, the investment branch of Credit Saison.

The money raised will be used to open more branches, improve Techfino’s technology platform, and grow its secured loan services for small and medium-sized businesses (MSMEs).

Techfino offers Loan Against Property (LAP) to small and medium-sized businesses (MSMEs) in tier II and III cities. It follows a branch-led approach and currently operates in Karnataka, Gujarat, Madhya Pradesh, and Andhra Pradesh.

Techfino also provides education loans through a B2B2C model by partnering with educational service providers to help students and families access financing.

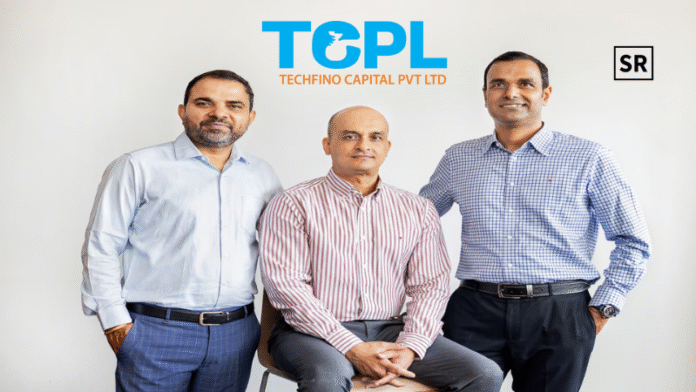

Techfino, based in Bengaluru, was started in 2019 by three experienced bankers — Rajesh Panda, Ratikanta Satpathy, and Jayaprakash Patra. The company began by offering loans to help people pay for coaching classes, school fees, higher education, and upskilling courses.

Recently, Techfino launched a second product—loans against property for small businesses. The company now plans to grow this service further to meet the increasing demand.

Techfino currently has a loan book worth INR 225 crore and aims to increase it to INR 350 crore. Out of this, INR 200 crore is expected to come from its Loan Against Property (LAP) services for small businesses.

For these secured loans, Techfino uses a branch-led model in Karnataka, Andhra Pradesh, Madhya Pradesh, and Gujarat. Right now, it runs 30 branches and plans to double that number by the financial year 2026 (FY26).

Techfino currently has about 400 employees and plans to open more branches and increase its team to around 600 people by the end of this year.

The company finished FY25 with INR 34 crore in revenue and made a profit of INR 1.5 crore before tax.

Read more- ArisInfra Solutions Raises INR 225 Crore from Anchor Investors Before IPO