Asia and the Pacific’s economic growth will remain steady this year and next, but expected USA policy changes under the incoming administration of President-elect Donald Trump are likely to affect the region’s longer-term outlook, according to a new report by the Asian Development Bank (ADB).

Read also – $500 Mn ADB Loan to Enhance India’s Green Infrastructure

Changes to USA trade, fiscal, and immigration policies could dent growth and add to inflation in developing Asia and the Pacific, according to the latest edition of Asian Development Outlook (ADO), released today. Because these significant policy changes are expected to take time and be rolled out gradually, the effects on the region would most likely materialize from 2026. Impacts could be seen sooner if the policies are implemented earlier and more rapidly than expected, or if USA-based companies front-load imports to avoid potential tariffs.

Read also – ADB, NaBFID to Collaborate on Financing India’s Infrastructure Sector

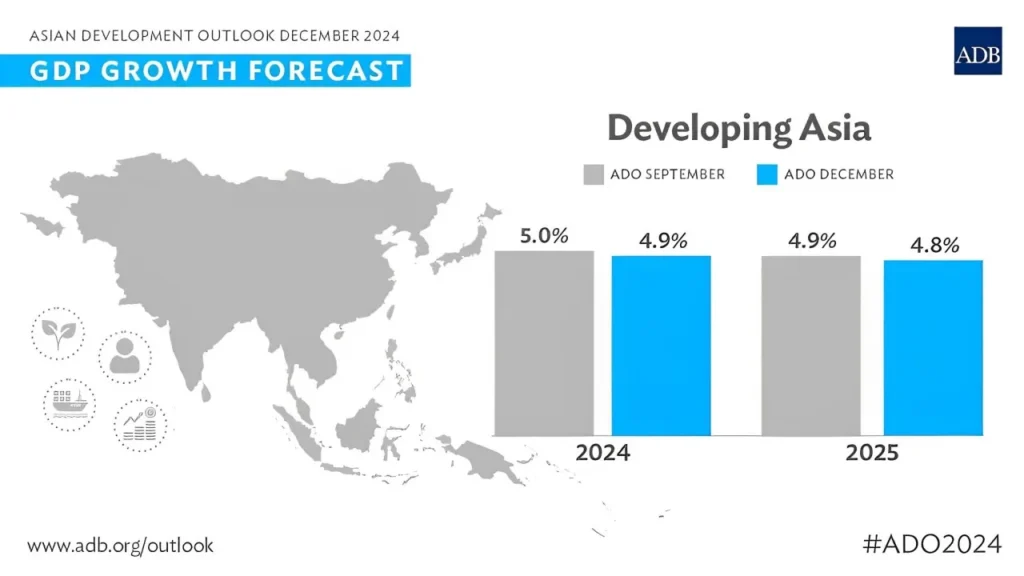

Developing Asia and the Pacific’s economies are projected to grow by 4.9% in 2024, slightly below ADB’s September forecast of 5.0%, according to the report. Next year’s growth projection is lowered to 4.8% from 4.9%, mainly due to weaker prospects for domestic demand in South Asia. The region’s inflation outlook has been trimmed to 2.7% from 2.8% for this year, and cut to 2.6% from 2.9% next year, partly due to an expected moderation in oil prices.

“Strong overall domestic demand and exports continue to drive economic expansion in our region,” said ADB Chief Economist Albert Park. “However, the policies expected to be implemented by the new USA administration could slow growth and boost inflation to some extent in the People’s Republic of China (PRC), most likely after next year, also impacting other economies in Asia and the Pacific.”

Under a high-risk scenario, ADB projects that aggressive USA policy changes could erode global economic growth slightly over the next 4 years, by a cumulative 0.5 percentage points. Broad-based tariffs are likely to dent international trade and investment, while leading to a shift toward more costly domestic production. At the same time, reduced immigration could tighten the USA labor supply. Combined with a potentially more expansionary fiscal stance under the incoming Trump administration, tariffs and migration curbs could rekindle inflationary pressures in the USA.

Despite the scale of the assumed USA policy changes, particularly on tariffs, the impacts on developing Asia and the Pacific are limited under this high-risk scenario. Even in the absence of additional policy support, gross domestic product growth in the PRC could slow by an average of only 0.3 percentage points per year through 2028. Negative spillover effects across the region, via trade and other links, would likely be offset by diversion of trade and relocation of production from the PRC to other economies.

In the near term, the outlook for most economies in the region remains relatively stable. The growth forecast for the PRC is unchanged at 4.8% this year and 4.5% next year. India’s outlook is adjusted downward from 7.0% to 6.5% for this year, and from 7.2% to 7.0% next year, due to lower-than-expected growth in private investment and housing demand.

Southeast Asia’s growth outlook has been raised to 4.7% this year from a previous forecast of 4.5%, driven by stronger manufacturing exports and public capital spending. The forecast for next year is unchanged at 4.7%.

The growth outlook for Caucasus and Central Asia has been raised to 4.9% this year from 4.7%, and to 5.3% next year from 5.2%, while projections for the Pacific are unchanged at 3.4% this year and 4.1% next year.

Apart from uncertainty surrounding USA policy changes, risks to developing Asia and the Pacific’s growth and inflation outlooks include escalations of geopolitical tensions as well as continued property market fragility in the PRC.

About ADB

The Asian Development Bank (ADB) is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. It assists its members and partners by providing loans, technical assistance, grants, and equity investments to promote social and economic development.. Established in 1966, it is owned by 69 members—49 from the region.