Weekly Funding Roundup 30 June to 5 July 2024– We compile a Weekly Startups Funding News Report summarizing all the startups that secured funding during the week. This report provides a consolidated list of these newly funded ventures day-wise, offering a concise overview of the latest developments in the startup funding landscape.

Asian Startups raised capital in order to expand and move into more successful. Here is this week’s Top 10 Asian Startups Funding Roundup.

Top 10 Asian Startups Funding News 30 June to 5 July 2024

Table of Contents

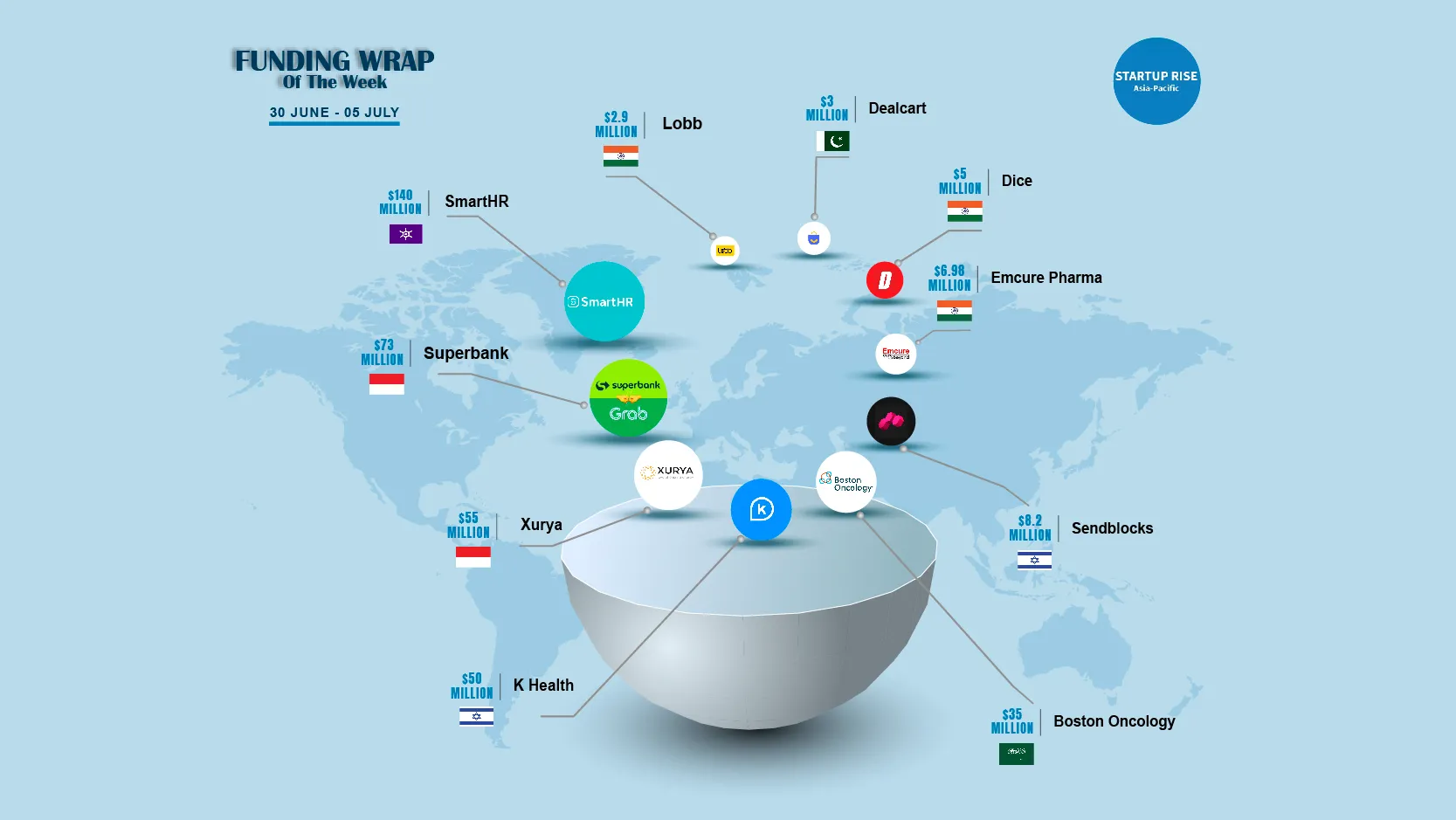

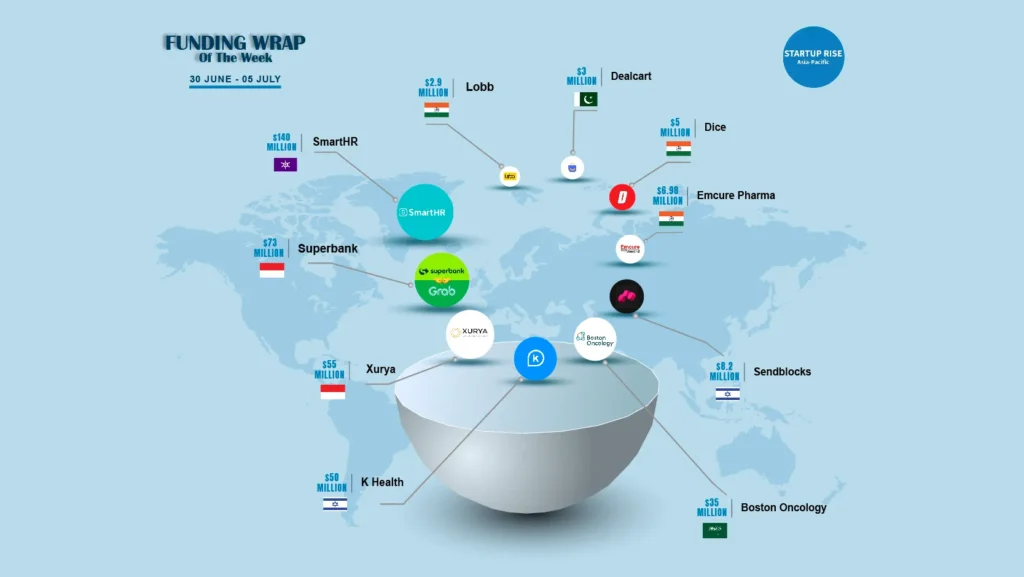

Funding Wrap of The Week | Asian Startups Funding Roundup | 30 June – 5 July

SmartHR

Tokyo Based SmartHR In its Series E funding round, which is co-anchored by private equity behemoth KKR and Teachers’ Venture Growth, the late-stage investment branch of Ontario Teachers’ Pension Plan, Japanese HR automation service provider SmartHR has raised $140 million.

With this deal, KKR is expanding its technological holdings in Japan, where it already owns dataX, a SaaS platform for marketing, and Yayoi, a provider of accounting and financial software for SMEs.

Superbank

Grab, Singtel, and KakaoBank, the owners of Indonesian digital banking player PT Super Bank Indonesia (Superbank), have agreed to contribute an additional 1.2 trillion rupiah ($73.2 million). As per the announcement released on Wednesday, the investment is intended to bolster Superbank’s offerings and advancements in product development.

Backed by an ecosystem of key industry players like Emtek Group, Grab, Singtel, and KakaoBank, the new investment will significantly strengthen Superbank’s capabilities and competitiveness in the Indonesian market.

K Health

K Health, an AI-powered personalized healthcare startup based in Israel and the US, has announced the closing of a $50 million funding round led by Claure Group.

Other investors in the round include Pablo Legorreta, the CEO and founder of Royalty Pharma, as well as current investors Mangrove Capital Partners, Valor Equity Partners, and Atreides Management, LP.

Xurya

PT Xurya Daya Indonesia , an Indonesian startup focused on renewable energy, has raised $55 million, with the Norwegian Climate Investment Fund administered by Norfund serving as the lead investor

British International Investment ,Singapore-based Clime Capital, which oversees Southeast Asia Clean Energy Fund II,Swedish government-backed Swedfund, and AC Ventures also participated in the round.

Boston Oncology

Boston Oncology Arabia, a bio-generic medication manufacturer situated in Riyadh, Saudi Arabia, has secured a USD 35 million investment. The money was invested by TVM Capital.

The company plans to utilise the money to complete fill and finish manufacturing at its regional production plant in Sudair Industrial City, as well as to improve its transition into full formulation.

Sendblocks

A blockchain data management firm based in Tel Aviv, Israel called Sendblocks has raised $8.2 million in seed money.

The money will be used by the business to grow both its operations and growth initiatives.

Emcure Pharma

Emcure Pharmaceuticals announced that, only one day before its inaugural share-sale offer opened for public subscription, it had received Rs 583 crore from anchor investors.

The anchor book comprises investors such as Abu Dhabi Investment Authority, Goldman Sachs Asset Management, Nomura, HDFC Life Insurance Company, ICICI Prudential Life Insurance Company, SBI Life Insurance Company, Nippon India MF, and Abu Dhabi Mutual Fund.

Dice

Dallas Venture Capital, a venture capital firm, led a $5 million Series A fundraising round for the enterprise expenditure management platform Dice. Venture capital firm GVFL participated in the round as well.

The firm announced on Wednesday that it will utilize the freshly generated cash for a range of go-to-market efforts, such as improving market penetration, expanding customer outreach, streamlining sales and marketing tactics, and bolstering its artificial intelligence capabilities.

Dealcart

Shorooq Partners and Sturgeon Capital led a $3 million venture fundraising round for DealCart, a social e-commerce firm based in Pakistan.

DealCart stated in a statement on Thursday that 500 Global, Evolution VC, Rayn Capital, and Khyber Venture Partners were also involved in the round.

Lobb

Lobb, a digital freight brokerage company based in Bengaluru, has raised $2.9 million. With the support of 3one4 Capital, the platform has become one of the nation’s fastest-growing digital freight brokerage networks, linking truckers and transporters nationwide.

According to a statement included in the release, the money will be used to expand the operations in more than 50 regions in order to access high-density routes.

Frequently asked questions (FAQs)

Name the Top 10 Asian Startups Funding Roundup in this week ?

SmartHR, Superbank, K Health, Xurya,Boston Oncology, Sendblocks, Emcure Pharma, Dice, Dealcart, Lobb are the Top 10 Asian Startups Funding Roundup in This Week.