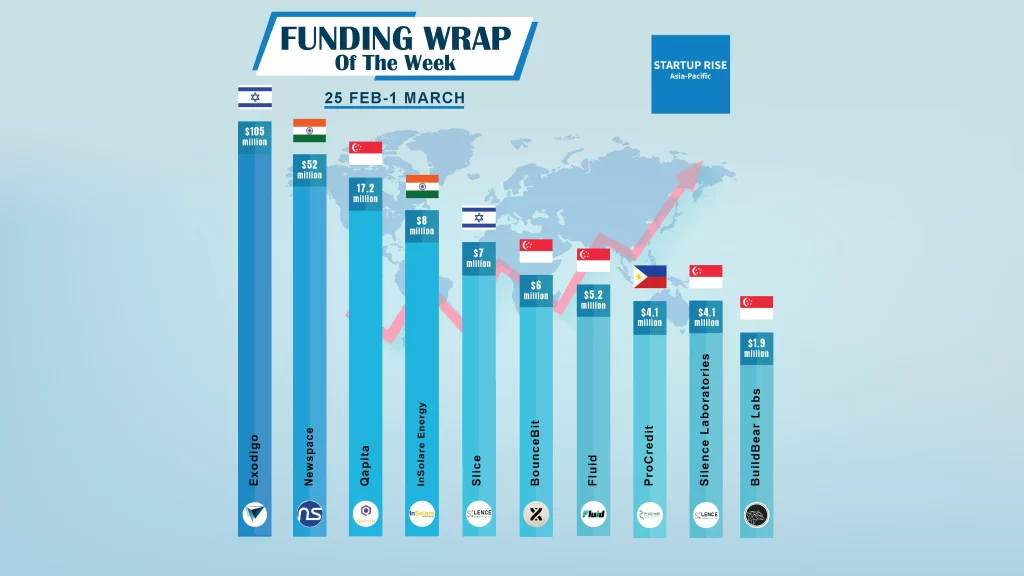

Many Asian Startups raised Funding in various Funding rounds from Venture Capitalists and Angel Investors in Asia Pacific. Let’s talk about Top 10 Asian Startups Funding Deals among them.

The Top 10 Asian Startups Funding Deals of This Week

Table of Contents

Exodigo

Exodigo, the artificial intelligence innovator modernizing underground mapping, today announced the close of a $105 million Series A round, converting $30 million previously secured in SAFEs, for a total of $118 million in funding since its launch in 2022. Greenfield Partners and existing investor Zeev Ventures co-led the Series A with participation from existing investors SquarePeg, 10D VC, JIBE and National Grid Partners.

Founded in 2021, Exodigo is the leading underground mapping solution for non-intrusive discovery. Our platforms combine multi-sensor fusion, 3D imaging, and AI technologies to create complete, accurate underground maps that enable confident decision-making for customers across the built world. We transform the project lifecycle for our customers, who include key community stakeholders in the utilities, transportation, and government sectors.

NewSpace Research and Technologies

NewSpace Research and Technologies (NRT) based in Bengaluru, designs and develops Persistent Drones for Earth Observation and Communications has secured $52 Million in a bridge Round. NRT received $33 Mn of equity from marquee investors and $19 Mn debt from SBI’s startup hub and SIDBI.

Founded in 2018, India’s fastest growing Aerospace & Defence R&D company. NRT’s vision is to be a leader in creating Unmanned Aerospace Systems for the global market from India. NRT is today developing multiple programs in Next Generation Mission & Technologies (NGM&T) in Aerospace and Defence for Military and Civilian use by the Indian Ministry of Defence, National Disaster Response Force, Ministry of Home Affairs, Department of Telecommunications and more.

Qapita

Singapore-based Qapita, an equity management platform with offices in Singapore, India, and Indonesia has secured US$17.2 Million funding Pre-Series B round from East Ventures, MassMutual Ventures Southeast Asia, and Cercano Management invested $3 million each and both existing and new investors. The round also saw participation from Nyca Partners, Citi, and Endiya Partners, Analog Partners.

Founded in 2019 by Ravi Ravulaparthi, Lakshman Gupta, and Vamsee Mohan, Qapita is an equity management platform with offices in Singapore, India, and Indonesia. We partner with progressive enterprises to help them seed, build, harness and eventually Unlock the Power of Ownership for their stakeholders.

InSolare Energy

InSolare Energy, a leading renewables EPC company dedicated to customer-centric and technology-driven solutions, has raised INR 66 Crore (approximately $8 million) in a growth funding round. Prominent names like Negen Capital, Mukul Aggarwal, Anchorage Capital Fund & Ankit Mittal – Khazana Tradelink also participated in the round.

Founded in 2009, InSolare has been an established market leader since 2009 with a strong team of technology leaders with 50+ Patents in Solar Technology. InSolare Energy has an experienced management team which has delivered multiple projects across India, with an engineering team having unmatched expertise in design through commissioning of PV Systems.

Slice

Slice, a global equity management and compliance platform has secured $7 Million in Seed Funding Round led by TLV Partners. Other investors such as R-Squared Ventures, Jibe Ventures and the international law firms Wilson Sonsini Goodrich & Rosati LLP and Fenwick & West LLP, plus several unnamed angel investors also participated in the seed funding round.

Founded by Maor Levran, Aviram Berg, and Yoel Amir, Slice is a global equity management and compliance platform that ensures employee equity grants comply with each country’s tax laws and regulations (which are complex and change frequently). Slice customers effectively manage their equity compensation plans, avoiding the risk of financial penalties, and optimizing the tax treatment of every employee’s equity.

BounceBit

Singapore-based BounceBit, a BTC staking chain solution has raised $6 Million in Seed Funding round led by Blockchain Capital & Breyer Capital. The round also saw participation from dao5, CMS Holdings, Bankless Ventures, NGC Ventures, Matrixport Ventures, Primitive Ventures, Arcane Group, IDG Capital, Bixin Ventures, Nomad Capital, Geekcartel, DeFiance Capital, General Mining Research, OKX Ventures, Mirana Ventures, HTX Ventures, Mexc Ventures, Bodhi Ventures.

Founded in 2023, BounceBit, a BTC staking chain solution, is dedicated to establishing a smart contract execution environment centered around the BTC Token, offering users a stable and low gas decentralized network to participate in DeFi, NFT and SocialFi activities.

Fluid

GoFluid.io, a Singapore-based fintech enabling flexible B2B purchase financing, raises US$5.2M in an equity round led by Insignia Ventures Partners. With US$1.8M raised in a seed round from Iterative and New Stack Ventures, the company brings its total funding to US$7M. The company looks to expand its product capabilities with this round and onboard bigger suppliers across industries to its platform.

Fluid was founded in early 2023 by fintech and ecommerce leaders CEO Trasy Lou Walsh, CPO Steven Li, and CFO Ruoyun Yang. Fluid—a GAME CHANGER. With just a tap, startup instantly finances B2B purchases within 10 seconds. It seamlessly integrates into marketplaces and supplier websites/apps, offering payment flexibility that empowers B2B buyers to secure their purchases on credit terms or installments.

ProCredit

Procredit Financing Corp, a Fintech start up which is part of a lending group funded by prominent VCs and business family offices based in Singapore and the Philippines has raised US$4.1 million pre-seed round of financing led by Integra Partners. Menardo Jimenez Family Office, M Venture Partners (MVP), Cento Ventures, Gobi Partners (Gobi-Core Philippine Fund), and several local angels also invested in pre-seed funding round.

Founded in 2023, ProCredit is a tech-enabled SME lender. Leveraging this deep domain expertise, its aims to become one of the largest SME lenders in the Philippines, employing a credit-first client engagement model, rules-based underwriting and portfolio management architecture, and flexible product offerings with risk-based pricing, all in service of providing best-in-class customer experience and closing the credit cap in the Philippines mid-market SME segment.

Silence Laboratories

Singapore-based Silence Laboratories, a cybersecurity company that focuses on the fusion of cryptography, sensing, and design has secured $4.1 Million in Pre-Series A round led by Pi Ventures, Kira Studio, and other angel investors.

Founded in 2022 by Dr. Jay Prakash, Dr. Andrei Bytes, and Dr. Tony Quek, Silence Laboratories is a cybersecurity company that focuses on the fusion of cryptography, sensing, and design to support seamless authentication experience. It has built a unique decentralized MFA (Multi-Factor Authentication) framework and MPC-based threshold signature implementation for solving fundamental authentication and account recovery pains faced by our B2B customers.

In various financing rounds, these startups raised funding from venture capitalists and angel investors, and secured place in the Top 10 Asian Startups Funding Deals of this Week.

Frequently asked questions (FAQs)

Which are the Top 10 Asian Startups Funding Deals of This Week?

Exodigo, Newspace, Qapita, InSolare Energy, Slice, BounceBit, Fluid, ProCredit, Silence Laboratories, and BuildBear Labs are the Top 10 Asian Startups Funding Deals of This Week.