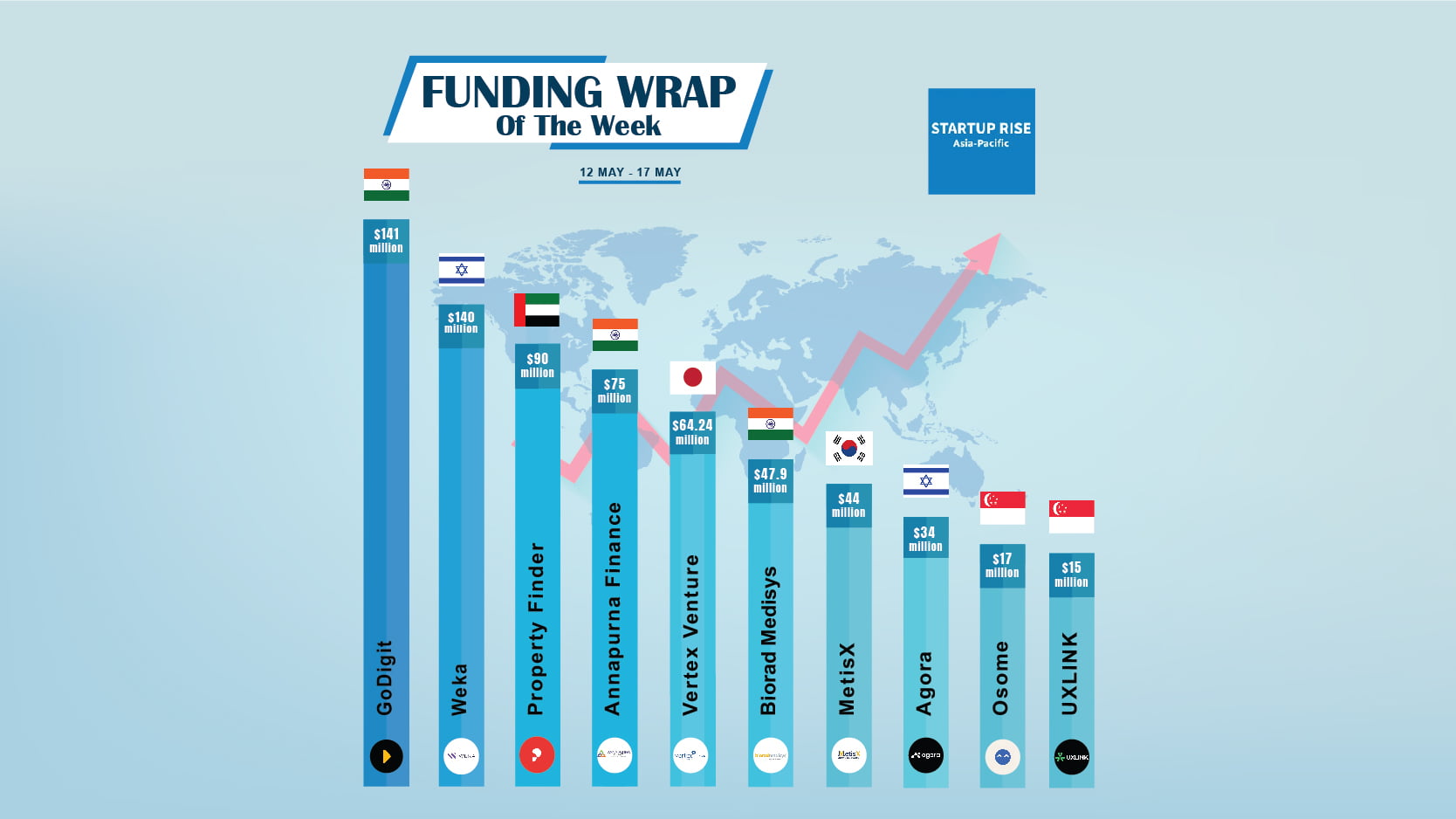

Asian Startups raised capital in order to expand and move into more successful. Here is this week’s Top 10 Asian Startups Funding Roundup.

The Top 10 Asian Startups Funding Roundup of This Week

Table of Contents

Go Digit

Go Digit, an Indian insurance startup, collected $141 million from dozens of investors in its Wednesday IPO.

In a stock exchange filing, Go Digit listed Fidelity, Goldman Sachs, Morgan Stanley, Abu Dhabi Investment Authority, Bay Pond, Mirae Asset Management, Steadview Capital, HSBC, and Indian mutual funds SBI, ICICI, Axis, Tata, and Edelweiss as anchor backers for the IPO.

Weka

Weka, an Israeli AI data platform, completed a $140 million oversubscribed Series E funding deal at $1.6 billion. In November 2022, it raised $135 million, increasing its $750 million valuation and becoming a unicorn. With this round, Weka has raised $400 million since its founding.

The company’s founders CEO Liran Zvibel, Omri Palmon, and Maor Ben-Dayan decided to minimise their participation in the financing round so veteran employees can receive share compensation.

Property Finder

Property Finder, a Dubai-based company, raised $90 million in debt from Francisco Partners to assist in funding the acquisition of its first institutional investor, indicating ongoing foreign interest in the booming real estate market in the United Arab Emirates.

The regional venture capital firm BECO Capital, which had invested in the now-owned Careem ride-hailing service and the now-defunct logistics startup Fetchr, repurchased its investment in the online real estate site.

Annapurna Finance

Piramal Alternatives, the Piramal Group’s fund management subsidiary, invested USD 75 million in Annapurna Finance Private Limited, an Odisha, India-based non-banking finance company focused on microfinance.

The transaction featured a combination of secondary share purchases and Tier – 2 capital. The strategic investment will drive the company’s AUM growth, promote market expansion, and strengthen its position as a participant in microfinance segment management.

Vertex Venture

Vertex Ventures Japan launched its $64.24 million inaugural fund, VVJFI, anchored by Vertex Holdings.

VVJ announced that VVJFI will invest in top Japanese firms with strong growth potential, robust growth drivers, and experienced management teams, leveraging it’s global venture capital network.

Biorad Medisys

Kotak Investment Advisors Limited, Kotak Mahindra Group’s alternative assets arm, announced on Tuesday that it has invested up to $47.9 million in medical equipment company Biorad Medisys through its Strategic Situations India Fund II.

Biorad Medisys, with production facilities in Pune, Maharashtra and Bengaluru, Karnataka, manufactures and sells orthopaedic implants for knees and hips, as well as surgeries and consumables for urology, gastroenterology, and neurovascular intervention.

MetisX

MetisX, a Seoul, South Korea-based startup employing compute express link technology to produce intelligent memory solutions, has raised $44 million in Series A funding.

Along with follow-on investors from the seed round, including Mirae Asset Venture Investment, Mirae Asset Capital, IMM Investment, SBI Investment, Tony Investment, and Wonik Investment Partners, the round also included new investors, including SV Investment, STIC Ventures, LB Investment, and the Industrial Bank of Korea.

Agora

Israel-based real estate investment management company Agora raised $34M in Series B. Insight Partners and Aleph joined Qumra Capital in the round.

The company plans to utilise the money to improve its product offerings and quicken its expansion efforts.

Osome

Osome, a Singapore-based platform for small and medium-sized business financial administration for entrepreneurs, has raised $17 million from both new and existing investors in its Series B extension round. The funding is a combination of debt and equity.

Two years ago, the company raised $25 million in a Series B investment led by Illuminate Financial, AFG Partners, and Winter Capital. This development occurs after that moment.

UXLINK

UXLINK, the industry-leading Web3 social infrastructure, has now revealed a fresh funding round, marking a critical milestone in its path. Driven by SevenX Ventures, INCE Capital, and HashKey Capital, this round drew in a number of investors, solidifying it’s lead position in the market.

This most recent funding round surpasses $5 million and brings it’s total funding to over $15 million.

Frequently asked questions (FAQs)

Name the Top 10 Asian Startups Funding Roundup in this week ?

GoDigit, Weka, Property Finder, Annapurna Finance, Vertex Venture, Biorad Medisys, MetisX, Agora, Osome, UXLINK, are the Top 10 Asian Startups Funding Roundup in This Week.