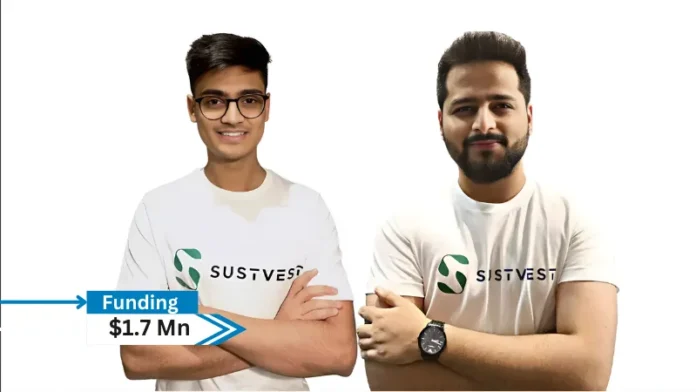

Sustainable Investment Platform SustVest has secured $1.7 million funding in Pre-Series A round in mix of equity and debt Led by Inflection Point Ventures and Antler along with participation from WEH ventures, Venture Catalysts, Soonicorn Ventures, FAAD Network, and others.

Read also – IFC Invests in TSKB to Boost Gender Equality and Employment in Türkiye

The funding will be used for strategic business plans such as solar project acquisition, expanding marketing activities for the platform, and improving operations.

Read also – OKI and FPT Announce Capital and Business Alliance to Strengthen Global Strategic Partnership

The platform allows fixed-income investment in environmentally friendly investments and empowers C&I consumers with access to zero-cost solar solution installations at up to 50% lower than the current price. Major clients are the Lodha Group, Hitachi, Mahle Group, and CISF. SustVest’s KYC practice enables investors to work with the company to invest in renewable energy through the regulated environment.

Mr. Ankur Mittal, Co-Founder, Inflection Point Ventures, says: “Many smaller investors find it difficult to invest in renewable energy due to high entry barriers. SustVest solves this by offering fractional ownership in renewable energy projects for investing. By doing so, SustVest is making sustainable investments more accessible to a broader audience and democratizing the renewable energy projects. In turn, helping investors earn passive income and promote the growth of clean energy initiatives.”

Hardik Bhatia, Co-Founder and CEO, Sustvest, says,” The investment opportunities once reserved for the ultra-wealthy are now accessible to all through SustVest, democratizing renewable energy investments. We’re building a gateway for EPCs to access finance for the OPEX model, bridging critical gaps in the ecosystem. IPV has been exceptional in understanding our vision and supporting us on this journey with their expertise, enabling us to scale our impact and bring clean energy closer to everyone.”

About SustVest

Founded in 2020 by Hardik Bhatia and Devansh Shah, SustVest is a sustainable Investment platform offering securitized debt instruments backed by Renewable Energy projects like solar helping investors earn 12-14% XIRRs while helping corporates, MSMEs and government clients transition to clean energy with zero upfront capital and helping save 40-50% in electricity costs