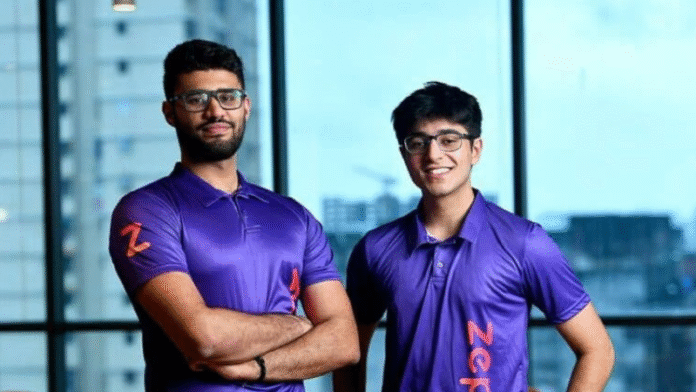

Zepto founders Aadit Palicha and Kaivalya Vohra are reportedly in advanced talks to raise about ₹1,500 crore in structured debt. Edelweiss has submitted a binding offer. The loan carries a minimum interest rate of 16%, with an equity-linked bonus that could increase total returns to around 18%. The funding is happening at a valuation close to $5 billion.

Quick commerce giant Zepto, founded by Aadit Palicha and Kaivalya Vohra, is reportedly in advanced talks to raise around ₹1,500 crore (approximately $175.6 million) through structured debt.

According to an ET report citing sources, the company is in discussions with Edelweiss Alternative Asset, domestic family offices, and smaller credit funds.

Edelweiss has submitted a binding offer, with the loan carrying a minimum interest rate of 16% and an equity-linked upside, pushing total returns to around 18%.

“Edelweiss has given a binding term sheet and will anchor the raise by committing half of the amount,” a source was quoted as saying in the report.

Sources also confirmed that the debt raise is happening at a nearly $5 billion valuation.

Inc42 has contacted Zepto for comments and will update the story once a response is received.

According to the report, Zepto plans to use the funds to buy shares from its existing foreign investors, which will help strengthen its domestic ownership ahead of a planned IPO.

The deal is structured for a three-year term and is expected to close by July, with Edelweiss underwriting most of the loan.

This development comes about a month after reports suggested Zepto was looking to boost its domestic shareholding by raising $100 million to $150 million in debt to buy back shares from existing investors.

Read also – U Mobile Appoints CT Sabah as Fiber Leasing Partner for 5G Expansion in Sabah and WP Labuan